Motives for an IPO — One of the primary problems of German SMEs is insufficient equity capitalization. Although an IPO (also known as going public) is an excellent way of raising equity capital, SMEs are reluctant to take advantage of it. In addition to the lack of information about an IPO, another reason is the predominance of family-owned or owner-managed companies among SMEs. Such companies find it difficult to include a large number of new shareholders in the previous (rather closed) circle of owners, to publish information on business development on a regular basis and to give external accountability.

Despite these arguments, a number of medium-sized companies that are still family-owned are listed on the stock exchange. Obviously — as surveys of listed companies show — the aspects of an IPO that are perceived as negative are (clearly) overestimated. Of course, the capital increase for the IPO requires an expansion of the circle of shareholders. However, the influence of the former owners on the company is not endangered as long as they hold the majority of shares. On the contrary, strengthening the equity base ensures the continuity and independence of the company for the previous owners. The information obligations arising from the stock exchange listing and the reactions of investors reflected in the share price development represent an effective corrective for a sustainable value-enhancing corporate policy. And it is the former owners who benefit most from this.

Irrespective of this, the entrepreneurial aspects should be in the foreground when deciding on an IPO. The (significant) improvement in the equity base associated with an IPO strengthens the company’s ability to adapt to changing environmental conditions. This is necessary because the majority of medium-sized companies today are faced with the problem that technological leaps, shorter product life cycles or necessary strategic investments require high financial input. At the same time, SMEs can no longer rely on extensive loan financing from banks, as they used to, especially when their equity capital base is weak. As a result, equity capitalization and the ability to raise equity capital are decisive factors in determining the competitive opportunities of companies.

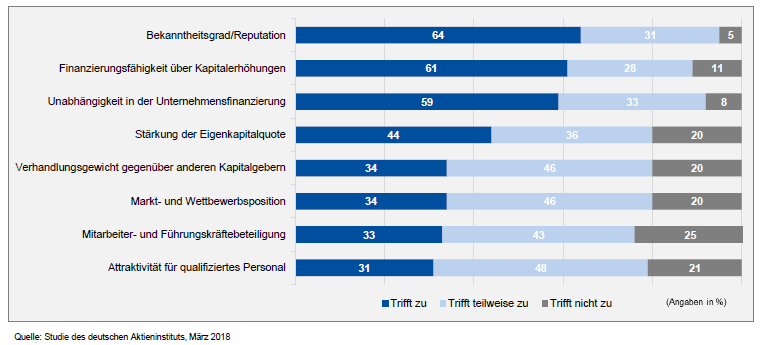

Growth financing is by far the dominant argument for an IPO. Nevertheless, an IPO is associated with a number of other positive effects for the development of the company and its owners:

- Strengthening of the equity base

- Independence of the company from the financial power of the owner

- Creation of company risk-free private assets through placement of shares of the former owners

- Safeguarding the life’s work “enterprise”, if there is no successor in the family

- Improvement of the reputation and increase of the level of awareness with positive effects for the products and services of the company

- Increase in creditworthiness and thus the scope for credit financing

- Greater employer attractiveness

- The shares can be used as an acquisition currency due to its fungibility and objective value

For more information, please order our free management reader “Successful on the Stock Exchange” at office@blaettchen.de.